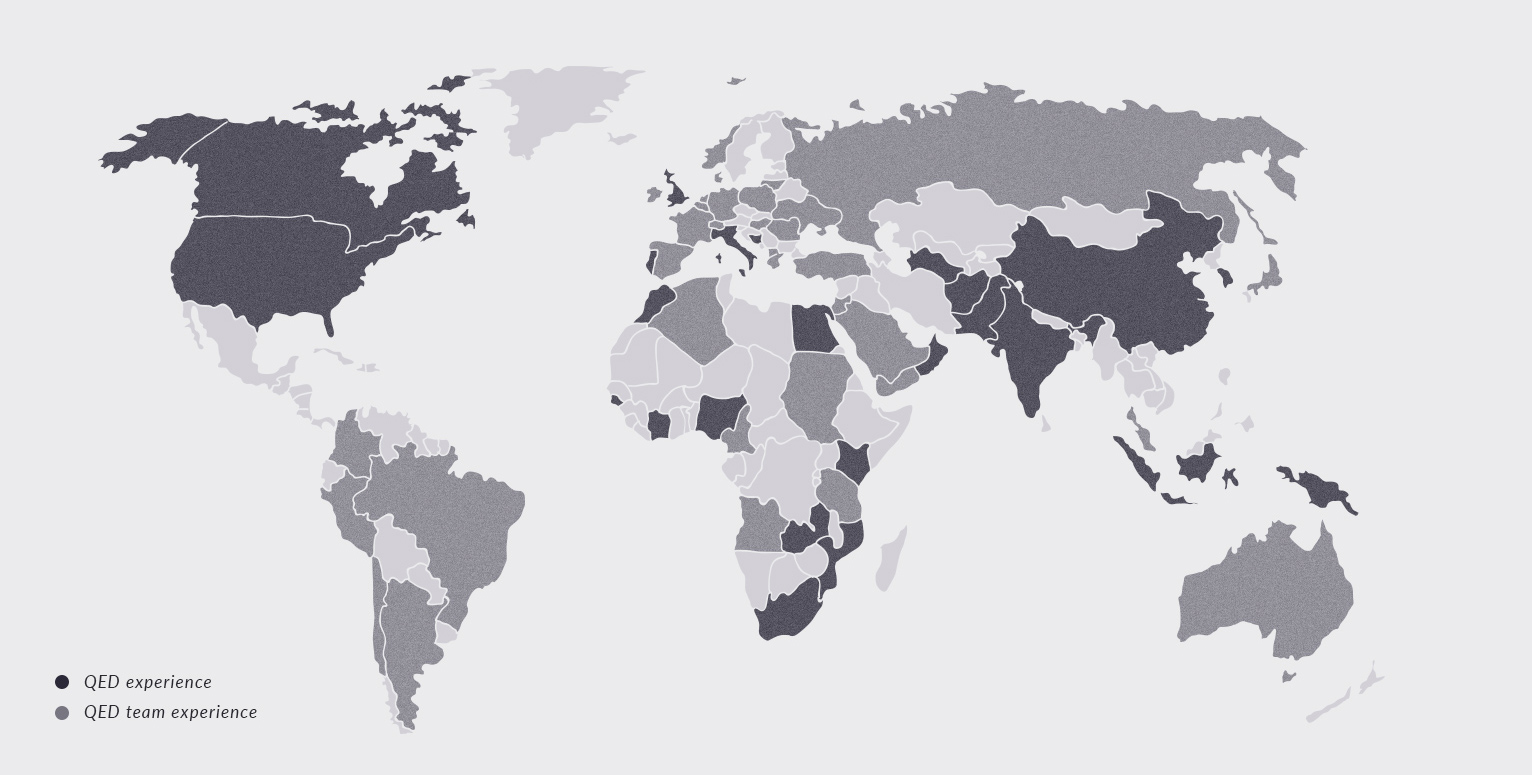

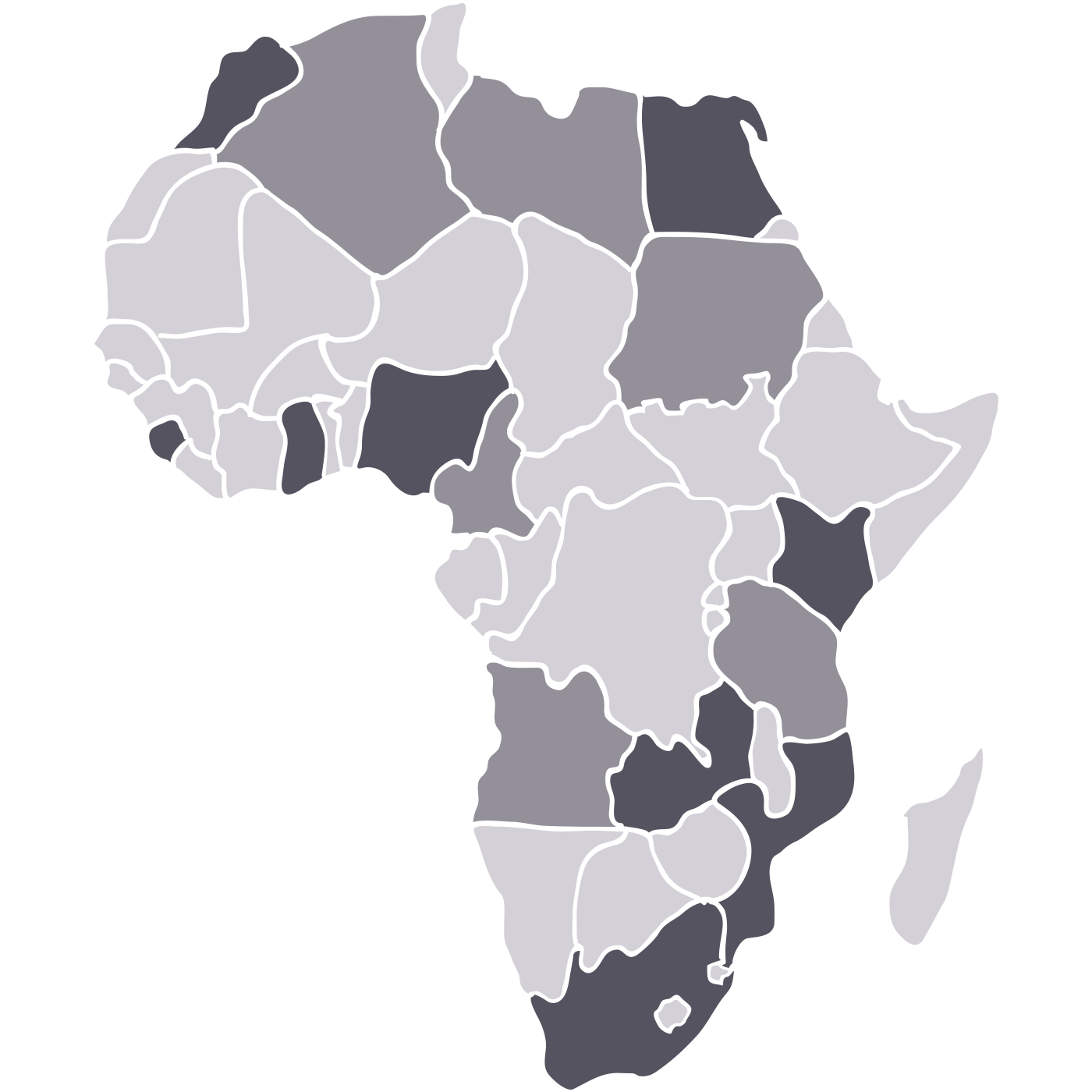

Advised a client on gas supply/demand and the negotiation of commercialization options for gas discovery in Algeria.

Advised Angola LNG in preparing their team for LNG and liquids production and delivery start-up, including developing and implementing a suite of key commercial procedures.

Advised a client on the development of onshore and offshore gas reserves in Cameroon for domestic and export use.

Advised the Ministry of Petroleum on the feasibility of developing oil and gas trading hubs in Egypt and on regional gas imports for LNG re-export through existing facilities.

Advised the new Gas Regulator in Egypt on Gas Market Reform, market design and other operational support.

Advised a West African gas player on commercial aspects of trading gas through the West Africa Gas Pipeline.

Advised the Government of Kenya on the development of a oil and gas master plan with a focus on crude oil exports (and oil products import) and gas-fired power generation. QED have continued to advise on the implementation of the master plan.

Advised a major European energy company in relation to a proposed greenfield LNG liquefaction project in Libya.

Commercial and Financial advisor to ONEE on the development of the LNG-to-Power project (2.4 GW) at Jorf Lasfar.

Advised an IOC in Mozambique on gas monetisation options and gas valuation with a focus on Ammonia production and export.

Advised NNPC on the implementation of the Nigerian gas master plan, including: design and implementation of a tender process for candidates to develop gas processing and pipeline facilities.

Advised IFC on commercial aspects and Open Season for the development of a Break-Bulk LNG import terminal.

Advised a potential developer on the proposed LNG-to-Power project initiative in South Africa, including LNG supply and partnering.

Advised a client on the commercialisation and negotiation of transportation agreements for crude oil export pipelines in Sudan.

Advised a client on the strategic development options of onshore gas reserves in Tanzania for domestic and export use.

Advised the Government on options for long term supply of petroleum products to Zambia including refining or importation, and related logistics, economics, pricing and regulatory matters.